The Law Office of Gregory I Becker

Wills, Trusts & Probate Law

A Professional Corporation

THE NEW ESTATE TAX REFORM WILL HAVE A MASSIVE IMPACT ON LIVING TRUSTS?

Trusts drafted prior to the summer of 2003 should be reviewed.

In 2003 Congress implemented a massive overhaul of the estate planning system. The laws that estate planners relied on changed dramatically. As a consequence, estate planning attorneys began writing living trusts that are drastically different than the ones written prior to the 2003 overhaul. After the 2017 tax reform, the same can be said.

One important feature to look for during the review is whether the trust forces a surviving spouse to split up trust assets following the death of the first spouse in order to maximize federal estate tax savings.

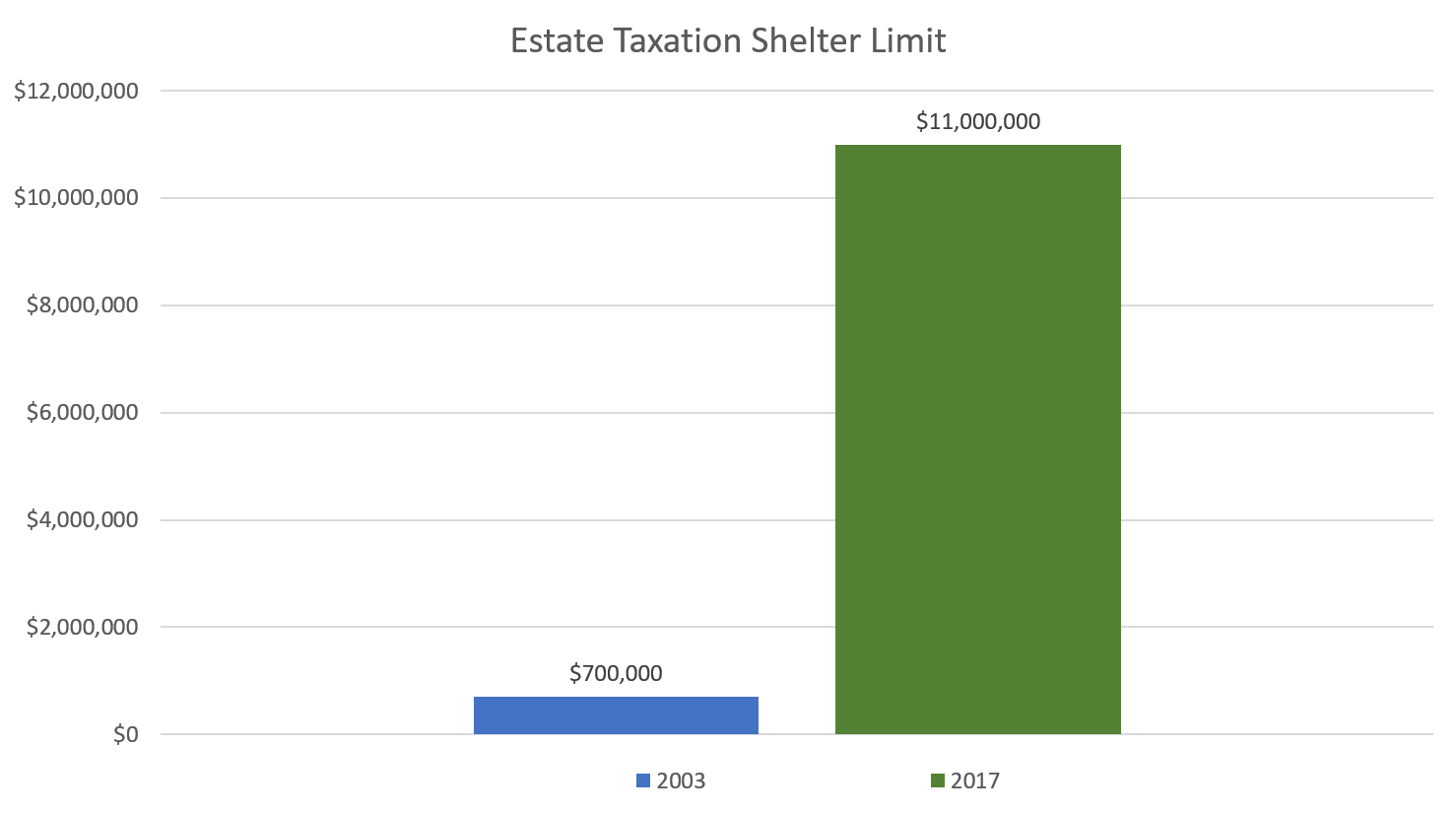

In the old days (prior to June 2003), the amount one could shelter from estate taxation was below $700,000. Now one can shelter over $11,000,000. For a husband and wife over $22,000,000 can be sheltered.

When the exemption was lower in 2003 sheltering the assets in a tax efficient trust made sense. Today, with such a large limit, forcing a split of assets when estate taxation is not an issue may lead to unintended consequences.

I often review these dinosaurs and recommend a complete amendment to the old trust to prevent the downstream problems of doing nothing. I recently drafted amendments to one such trust and while the spouses were reviewing the paperwork, one spouse died before we could put the updates in place.

The moral to the story is, have your trust reviewed and don’t wait to take action.